Budget 2021 Malaysia Tax

29 2021 831 am. Reduction of individual income tax rate.

14 hours agoPublished October 29 2021 609 AM.

Budget 2021 malaysia tax. The following is the summary of tax measures for Malaysia Budget 2021. Finance Minister Datuk Seri Tengku Zafrul Abdul Aziz said the government wants to encourage people to buy these vehicles and their long-term plan is to make Malaysia carbon neutral by 2050. 13 hours agoMalaysia plans windfall tax for rich companies in new budget 2021-10-29 200945.

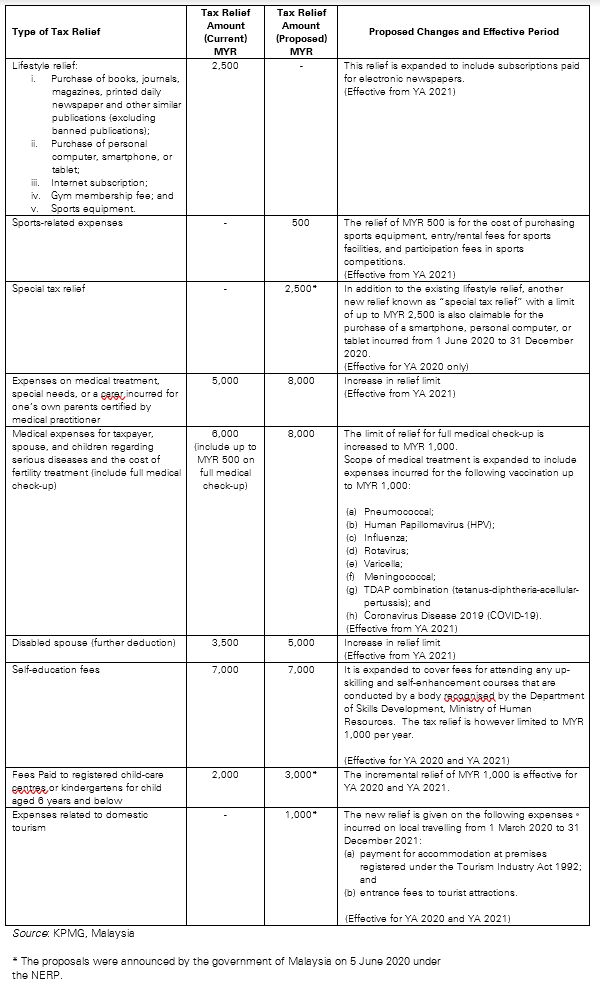

16 hours agoBudget 2022. TaXavvy Budget 2021 Edition - Part 1 8. Malaysia presented the 2021 Budget proposals announcing a slight reduction in the individual income tax rate by 1 percent for resident individuals at the chargeable income band of MYR 50001 to MYR 70000.

14 hours agoIn this photo released by Malaysias Department of Information Malaysias Prime Minister Ismail Sabri Yaakob delivers the 2022 budget speech at parliament in Kuala Lumpur Malaysia. 20202021 Malaysian Tax Booklet. Malaysia Tax Measures Affecting Individuals in Budget 2021.

14 hours agoMalaysia plans windfall tax for rich companies in new budget. Income tax rate for resident individuals be reduced by 1 from 14 to 13 for the chargeable income band of RM50001 to RM70000 from YA 2021. 14 hours agoMalaysias government is proposing a record budget for 2022 to bolster an economic recovery following the coronavirus pandemic with industrial incentives and.

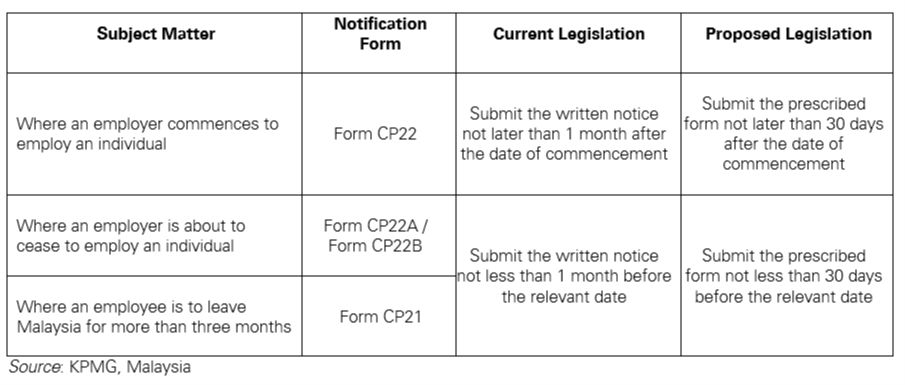

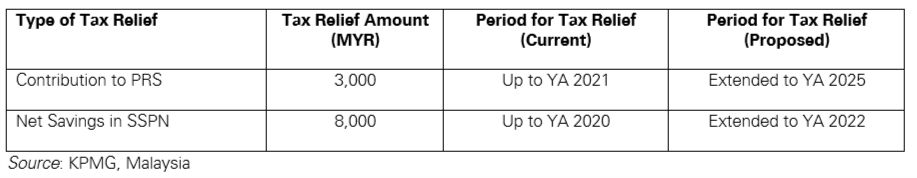

14 hours agoMalaysia plans windfall tax for rich companies in new budget. Delivers the 2022 budget speech at parliament in Kuala Lumpur Malaysia Friday Oct. There is also an increase an extension and an expansion of the scope of tax reliefs.

Relief on expenses for medical treatment special needs and parental care to be increased from RM5000 to RM8000. 14 hours agoMalaysias government is proposing a record budget for 2022 to bolster an economic recovery following the coronavirus pandemic with industrial incentives and. 16 hours agoBudget 2022.

Posted October 29 2021 0709 AM CDT Has been updated. In Cars Hybrids EVs and Alternative Fuel. 18 hours agoMalaysia on Friday announced a record spending plan for 2022 and proposed a one-time tax on some corporates as it seeks to revive its virus-battered economy.

A general view of Petronas Twin Towers in Kuala Lumpur October 28 2021. The proposed national Budget for the year 2021 contained a number of interesting income tax initiatives that you should be aware about. KUALA LUMPUR Malaysia AP Malaysias government has proposed record spending.

Malaysia plans windfall tax for rich companies in new budget October 29 2021 admin Finance 0 Malaysias government has proposed record spending for 2022 to bolster post-pandemic economic recovery with various industrial incentives and cash handouts for the poor and windfall taxes for high-income companies. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices. Also proposed is a reduction in contributions made to the Employees Provident Fund.

15 hours agoKUALA LUMPUR Oct 29 Electric car enthusiasts or those wishing to buy one will now get tax exemption as part of Budget 2022 incentives. It is proposed that the resident individual tax rate be reduced by 1 from 14 to 13 for the chargeable income band RM50001 to RM70000. These proposals will not become law until their enactment and may be amended in the.

This booklet also incorporates in coloured italics the 2021 Malaysian Budget proposals announced on 6 November 2020 and the Finance Bill 2020. It is proposed that the resident individual tax rate be reduced by 1 from 14 to 13 for the chargeable income band RM50001 to RM70000. From expanded medical tax reliefs to an anticipated income tax reduction here are the personal income tax highlights from Budget 2021.

EVs in Malaysia to be completely tax free soon zero import and excise duties free road tax. Malaysia plans windfall tax for rich companies in new budget. Malaysias government has proposed record spending for 2022 to bolster post-pandemic economic recovery with.

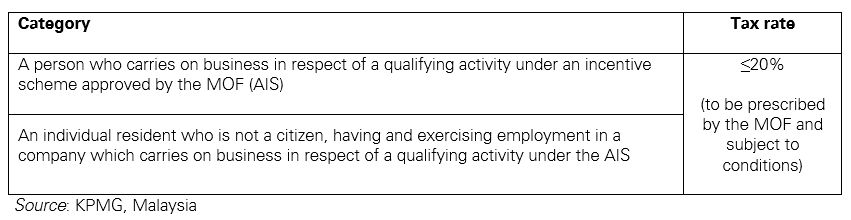

The preferential tax rates of 0 to 10 for selected manufacturers to relocate their operations to Malaysia will be extended to companies in selected services sectors and the application period will be extended to 31 December 2022 Please find below a snapshot of the key tax proposals based on the Budget 2021 speech. Budget 2021 was announced on. He also announced a 100 road tax exemption for EVs.

14 hours agoIn this photo released by Malaysias Department of Information Malaysias Prime Minister Ismail Sabri Yaakob center and Finance Minister Zafrul Aziz second from left walk together to delivers the 2022 budget speech at parliament in Kuala Lumpur Malaysia Friday Oct. Non-resident individuals tax rate remains at a flat rate of 30. Putrajaya introduces one-off windfall tax on companies earning at least RM100m.

Finance Minister Datuk Seri Tengku Zafrul Abdul Aziz said the tax which will be 24 per cent for the first RM100 million and 33 per cent for the rest above that is to ensure that. October 29 2021 730 am CDT In this photo released by the Malaysian Intelligence Agency Malaysian Prime Minister Ismail Sabri Yaakob is giving a 2022 budget speech to the Malaysian Kuala Lumpur Parliament on Friday October 29 2021. Famer RoheniMalaysias Department of Information via AP.

14 hours agoMalaysia plans windfall tax for rich companies in new budget.

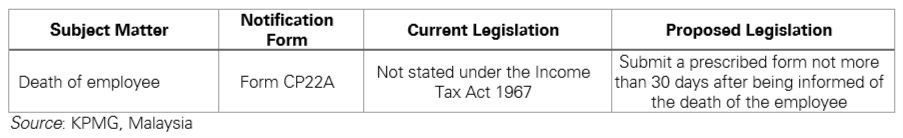

My Tax Measures Affecting Individuals In Budget 2021 Kpmg Global

My Tax Measures Affecting Individuals In Budget 2021 Kpmg Global

Automotive Capstone Projects Online In 2021 James Franco Spring Breakers Exam Review Health Science

Understanding The Budget Revenues

Pin On Economies And Governments

Crystal Mosque Kuala Terenganu Malaysia In 2021 The Good Place Most Beautiful Paintings Building

My Tax Measures Affecting Individuals In Budget 2021 Kpmg Global

Prs Tax Relief Private Pension Administrator

My Tax Measures Affecting Individuals In Budget 2021 Kpmg Global

My Tax Measures Affecting Individuals In Budget 2021 Kpmg Global